It used to be anybody who forged a banking transaction would end up in deep legal trouble. Not anymore – at least if you’re a banker. You might get fired as four senior Wells Fargo managers were recently. But the police won’t be looking for you.

What’s worse, if you are a victim of the fraud, there maybe little you can do about it, because the corporations have come up with a new legal “get out jail free card” they can use to insulate themselves from responsibility for a wide variety of crimes in almost any line of business.

The fired Wells Fargo executives were implicated in a scheme in which the bank created up to two million phony accounts in the names of its customers without their knowledge. The company then charged the legitimate accounts of those customers for fees created by the fake ones. This went on for about a decade until it was exposed last year.

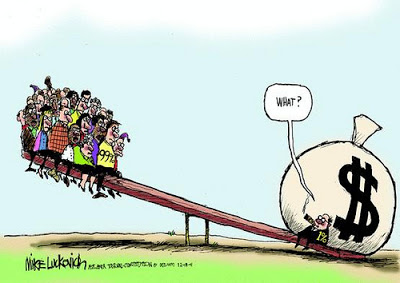

Although the bank paid a federal fine, no one at Wells is being prosecuted. The CEO, John Stumpf, retired with $124 million in stock and other benefits — on top of his generous salary.

The bank did fire 5300 workers who created fake accounts under intense pressure to meet sales goals not achievable through ethical sales practices. Yet the supervising executive in charge of the branches, Carrie Tolstedt, retired at the end of last year after being paid $27 million dollars over the last three years (not including stok bonuses).

So what about the customers who were defrauded? Although the amount each of them lost was relatively small, usually about $25, many of them are understandably outraged and have sued the bank. Ordinarily, no one could afford to take on a large corporation for a $25 fraud claim. Instead the lawyers for the bank’s victims used a “class action lawsuit” in which they can represent large numbers of clients in a single case.

But buried in the agreement customers signed when they opened their accounts was a phrase stipulating all disputes with the bank would be settled through binding arbitration, in which the parties argue before a supposedly independent arbitrator who makes the decision. The arbitrator’s ruling typically cannot be appealed to a public court.

In practice, arbitration favors the corporation contracting the arbitration firms, since those companies depend on repeat business from their corporate clients. However, the arbitration rules don’t offer any protection from these potential conflict of interests.

The problem for the victims of Wells Fargo’s fraud isn’t just that they are unlikely to get a fair shake in arbitration. They won’t get a hearing at all because almost all of these agreements prohibit any kind of class action. Instead each individual has to bring his or her case on their own. This would mean spending thousands of dollars and huge amounts of time to seek restitution for a $25 theft. And if the arbitrator rules against them, they may be liable for a big bill from their lawyer and the arbitrator.

These binding arbitration agreements have spread like a plague since a pair of Supreme Court decisions in 2011 and 2013. They affect just about any business one does with a large corporation including Amazon, Netflix, Travelocity, eBay and DirecTV, AT&T and countless others.

According to a multipart series on arbitration in the New York Times, the legalization of the binding arbitration gambit was the goal of a “Wall Street-led coalition of credit card companies and retailers.” In 2011 the Court handed down the first of the two crucial decisions, AT&T LLC v. Concepcion, that made get out of jail free a reality. By that time one of the lawyers who worked with the coalition, John G. Roberts Jr. was the Court’s Chief Justice.

The Roberts Court overturned a California state court decision declaring AT&T’s arbitration agreement an “unconscionable contract” because it exempted the “party with superior bargaining power” from “responsibility for [its] own fraud.” In doing so, the California court’s decision was in keeping with a centuries-old legal tradition concerning unfair contracts.

But the Supreme Court twisted the meaning of a 1925 federal law that simply established the legal standing of arbitration agreements except as long as they don’t violate the legal standards applicable to contracts in general. Instead, the Court decided the law placed the goal of “efficient, streamlined procedures” to solve disputes ahead of any concerns about fraud.

The lower courts responded by throwing out hundreds of class action suits and the number of cases brought by consumers and small businesses dropped precipitously. Then in a 2013 decision, American Express Company v. Italian Colors Restaurant, the court denied a claim by a restaurant owner that an arbitration clause the company inserted into its credit card contract violated antitrust laws. The dissenters on the court made it clear what this decision meant: “The monopolists gets to use its monopoly power to insist on a contract effectively depriving its victims of all legal recourse.”

Forced arbitration is also a threat to individual victims of corporate crimes who are not part of class action suits. According to the Times, arbitration has impeded legal redress for people dealing with private schools and colleges, doctors, home construction firms, cemeteries and nursing homes.

Binding arbitration is also becoming common in employment contracts. The Times described the experience of a doctor who sued the medical group that employed her for workplace discrimination. When she showed the company had destroyed evidence, the arbitrator fined the company $1,000 and then billed the doctor $2,000 for the time he spent looking into it. When the arbitrator decided in favor of the employer, the doctor was stuck with a $200,000 legal bill, including $58,000 she owed the arbitrator.

Wells Fargo recently agreed to a $110 million settlement with customers victimized by the phony account scheme. It did so despite having successfully played its get out of jail card in court because its management decided to counter the bad publicity. As the bank’s new CEO Tim Sloan explained, the settlement is “another step in our journey to make things right with customers and rebuild trust.”

With forced arbitration, individual citizens as well as small and medium-sized business are being rendered legally powerless against the hostile corporate takeover of a large part of our civil justice system. But there is a silver lining in all of this. The Supreme Court’s rulings rest on the slender reed of a single law. The federal government could nullify those rulings by enacting a new law making it clear the Federal Arbitration Act does not support “unconscionable” contracts.

Getting such changes passed will not be an easy task in the current political environment. On the other hand, the arbitration gambit also creates an opening for a counter move. This issue affects almost everybody who is not extremely wealthy regardless of their race, religion, class or political belief. They can demand that their representatives fix this law. Regardless of whether or not the fix is enacted, a broad cross section of citizens will find out who in Washington is working on their behalf and who isn’t.

Jeffrey Kaplan writes from the San Francisco Bay Area